What many people don’t realize is that business credit cards work a little bit differently than a personal credit card.

For example, many banks do not report these balances and transactions or even the credit lines to your personal credit report and this can be extremely beneficial when you’re trying to get a small business or side hustle off the ground.

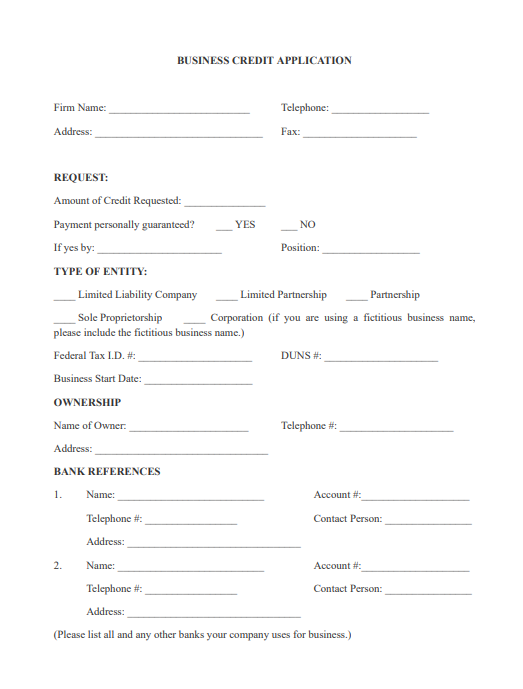

The business portion of the application.

- Start with your email address. Feel free to put whatever email you actually use in check. It does not have to be a business email address. It could be your personal email, the one that you use for correspondence.

- Enter your business information is the part that trips people up the most. For example, if you are a sole proprietor if you’re an independent contractor, a gig worker, essentially if you’re self-employed, and work for yourself, then your legal business name is going to be your first and last name. Type that in the application.

- Check the box that says company does not have a DBA. If your business don’t have it.

- The next part of the application, It’s going to ask for your business address and fill in your home street address, especially if you work from home.

- On the next line, it’s going to ask you for your ZIP code.

- Up next is going to ask for your business phone number. Put down your cell phone number. If you have a business line you would put that number in there. But, they’re looking to get in touch with you send you text messages for verification purposes, so just put down the number that you use most often.

- Up next, they’re going to ask for your industry type. Just take a look at the choices and choose whatever you think most appropriately fits your line of business or choose other.

- Next, company structure and if you’re not familiar with these terms. If you work for yourself and you’re self-employed put down sole proprietor. If you work in partnership, put partnership and if you work for a corporation, put corporation.

- For the next few boxes, it’s just important to remember how long you’ve been in business and have a grasp of how much money you’re bringing in.

- Next, the number of employees. Put down whatever the number of your employees for your business.

- The next number is going to determine what sort of credit limit they give you.

- Next is they’re going to ask you your role in the company.

This ends the business portion of the application.

They have all the business information, and now they just need some personal information about you.

- First, fill in your first and last name.

- There is a box you can check that says your home address is the same as your business address if you work from home.

- Next, fill in your cell phone number.

- Next part they are going to ask for your social security number. What they do is verify your identity. You’re applying for this card even though it’s a business card and some of the benefits won’t show up on your personal credit. They still need your social security number to verify your identity. After you fill in the social security number they’re going to match that with your date of birth. Put that as well.

- Then the next portion, if your business is newer and you’re worried about getting approved for a business card. They’re going to ask for your total annual income. They’re asking you for all the income that you have access to and that’s in your household so for someone let’s say who is married, or you work a few different jobs. They’re going to ask for all the income you make and so if your business is brand new or it’s only making a little bit you can include that amount. You can also include the other income that you have access to.

- They also ask for non-taxable income.

The last thing you do is just to submit your application.

Related Forms:

Other Forms

- Affidavit Forms

- Assignment Forms

- Attorney Forms

- Bankruptcy Forms

- Bill of Sales Forms

- Borrow, Lend & Collection Forms

- Business Forms

- Confidentially Forms

- Contract Forms

- Copyright Forms

- Corporation Forms

- Credit Form

- Declaration Form

- Deed Forms

- Divorce Forms

- Employment Forms

- Entertainment Contract Forms

- Family Law Forms

- Free Will Forms

- Government Form

- Health Care Forms

- Homestead Form

- Indemnity Agreement Form

- Intellectual Property Forms

- Internet Forms

- Landlord and Tenant Forms

- Lease and Rental Forms

- Letter Forms

- Limited Liability Co. Form

- Non-Compete Forms

- Non-Disclosure Forms

- Notice Forms

- Parental Permission Forms

- Partnership Forms

- Power of Attorney Forms

- Premarital Forms

- Promissory Notes

- Real State Forms

- Release Forms

- Sale & Purchase Forms

- Technology Forms

- Trademarks Forms

- UCC Forms

5/5

0

Downloads

"Formscatalog.com is my go-to-site for my templates and document needs."

Charles T. Bachman

Lawyer