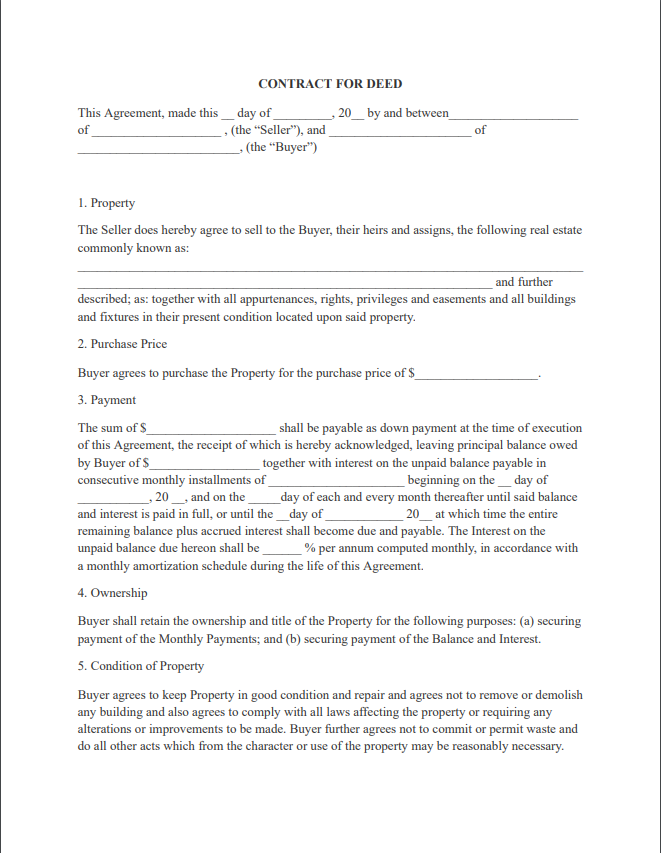

A Contract for Deed is an alternative financing arrangement between the seller and the buyer of the property. In a contract forgiven arrangement the seller is going to act more like a bank or a lender and finance the sale of the property for the buyer. In exchange, the buyer will typically put 10 to 20 percent down depending on what the agreement is and make monthly payments until the balloon payment is due.

Usually, the duration is going to be three to five years or so on a typical contract that we see in Minnesota and by that time you will have to either pay off the contract in full or obtain a mortgage and refinance out of it.

Sometimes we see contract for deed, buyers sell the property keep whatever equity that they gained throughout the ownership and pay off the seller that way without ever having to get a mortgage or paid off and full which is also a really good option to consider if you are not planning on staying there a long term.

In a contract for deep monthly payments are going to be calculated very similar to like any other loan. You’ll have a 20 to a 30-year amortization and depending on the purchase price and the down payment your monthly payment will be calculated that way. You can always find an amortization schedule calculator online and plug in the numbers to find out how much you’ll be paying.

The beauty of a contract for you is that you don’t have to pay mortgage insurance premium like you normally do in a traditional sale, like a conventional FHA or VA loan but their interest rate is going to be a little bit higher. So the difference between those payments is typically within a few hundred bucks.

When you buy a house on a contract for deed, you are treated as a property owner. The sale gets recorded at the county you are showing up as a property owner, you can homestead the property, and at the same time, the insurance or the homeowner’s insurance is also in your name.

You can choose to make your property taxes and insurance payments every month to the seller and then the seller can make those payments on an annual or semiannual basis or you can also responsibility on yourself and make just principle and interest payments to the seller and make your insurance and property taxes payment separately. Either way is fine as long as both you and the seller are comfortable doing it.

Now, there are really only about two ways to buy a house on a contract for deed in Minnesota

- Going directly through the property owner,

- The other option is to use a third-party investor that would purchase the house for you to carry the note for the duration of the balloon term and get the seller out of the picture so that the seller can get their payoff check, walk away from the property, you gain ownership, and a third party investor is just there to provide the finances.

Related Forms:

Other Forms

- Affidavit Forms

- Assignment Forms

- Attorney Forms

- Bankruptcy Forms

- Bill of Sales Forms

- Borrow, Lend & Collection Forms

- Business Forms

- Confidentially Forms

- Contract Forms

- Copyright Forms

- Corporation Forms

- Credit Form

- Declaration Form

- Deed Forms

- Divorce Forms

- Employment Forms

- Entertainment Contract Forms

- Family Law Forms

- Free Will Forms

- Government Form

- Health Care Forms

- Homestead Form

- Indemnity Agreement Form

- Intellectual Property Forms

- Internet Forms

- Landlord and Tenant Forms

- Lease and Rental Forms

- Letter Forms

- Limited Liability Co. Form

- Non-Compete Forms

- Non-Disclosure Forms

- Notice Forms

- Parental Permission Forms

- Partnership Forms

- Power of Attorney Forms

- Premarital Forms

- Promissory Notes

- Real State Forms

- Release Forms

- Sale & Purchase Forms

- Technology Forms

- Trademarks Forms

- UCC Forms