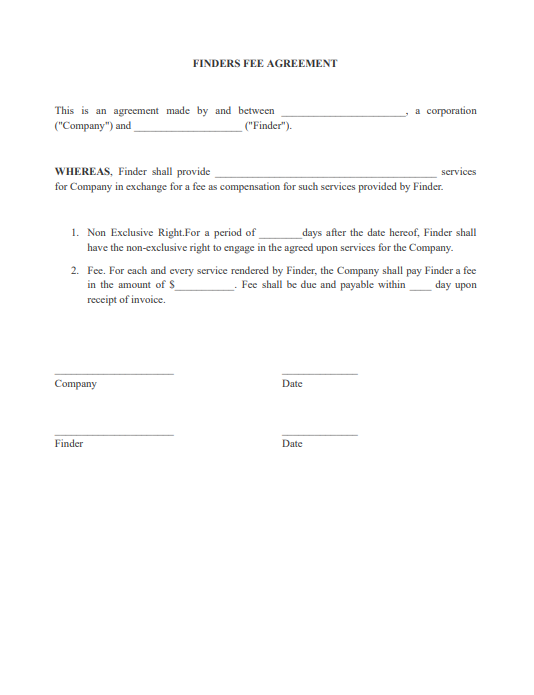

A finder’s fee agreement is a contract between a person or business (the “finder”) and another person or business (the “client”). The finder agrees to find potential customers or clients for the client, and the client agrees to pay the finder a fee for each successful referral.

A Finder’s Fee Agreement is used when an individual seeks out a business relationship on behalf of another. It identifies the parties and the specific services the finder will perform on either an exclusive or non-exclusive basis.

It is a document used to solidify an understanding between a finder and a company or individual in which the finder will be providing services to find potential customers or business opportunities. The finder fee agreement outlines the terms of the arrangement, including the finder’s compensation, expenses, and any other conditions that should be met. This type of agreement is typically used when working with sales agents, independent contractors, or other third-party service providers.

The finder’s fee may be a fixed amount or a percentage of the transaction value, and it is typically paid after the deal is finalized. Finder’s fees are common in the real estate and venture capital industries, but they can be used in any situation where one party has expertise in finding potential customers or clients.

If you’re thinking about entering into a finder’s fee agreement, it’s important to have a clear understanding of the terms of the agreement. What exactly is the finder’s fee? Who is responsible for finding potential customers or clients? When is the finder’s fee paid? These are all important questions that should be answered in the agreement.

It’s also important to consult with an attorney to make sure that the agreement complies with state and federal laws. For example, finder’s fees are generally prohibited under anti-kickback laws unless certain conditions are met. Failure to comply with these laws can result in civil and criminal penalties.

If you are the one sending the referral or the finder’s fee, fill up the referring broker section. And if you’re the one receiving the referral, you’re the recipient broker.

Complete all of the information. Fill in the principal’s information. (client’s information). Fill out the appropriate information in the agreement section.

The % of total gross compensation earned by recipient broker or payable upon recordation of deed and other evidence of transfer, and if within how many months or years from the date of the agreement.

Then identify if it’s valid

- for a buy,

- for a sell,

- for lease,

- or something else.

Get the signature of the brokers, this has to go to the jury so they can get the broker whether who is the referring side or the recipient side.

Have the agreement signed before you send the referral information. It would be very out of culture and unethical for an agent to receive the referral and then not pay. However, it is a contract business if this isn’t done beforehand that could leave the agreement open for some challenges, the same thing the other way.

Sign as quickly as possible and then get that back to them if you are the receiving agent for a referral from another market center.

Related Forms:

Other Forms

- Affidavit Forms

- Assignment Forms

- Attorney Forms

- Bankruptcy Forms

- Bill of Sales Forms

- Borrow, Lend & Collection Forms

- Business Forms

- Confidentially Forms

- Contract Forms

- Copyright Forms

- Corporation Forms

- Credit Form

- Declaration Form

- Deed Forms

- Divorce Forms

- Employment Forms

- Entertainment Contract Forms

- Family Law Forms

- Free Will Forms

- Government Form

- Health Care Forms

- Homestead Form

- Indemnity Agreement Form

- Intellectual Property Forms

- Internet Forms

- Landlord and Tenant Forms

- Lease and Rental Forms

- Letter Forms

- Limited Liability Co. Form

- Non-Compete Forms

- Non-Disclosure Forms

- Notice Forms

- Parental Permission Forms

- Partnership Forms

- Power of Attorney Forms

- Premarital Forms

- Promissory Notes

- Real State Forms

- Release Forms

- Sale & Purchase Forms

- Technology Forms

- Trademarks Forms

- UCC Forms