Indemnity Agreements are used when one party agrees to protect another against anticipated lawsuits or claims. This agreement sets out the specific action for indemnified party (such as construction of a playground or parking structure) and that all signing parties are bound by the agreement.

To understand what an indemnity agreement is, we first need to understand what indemnity means. Indemnity is basically just protection against a loss.

Many high risk activities like skydiving and bungee jumping require you to sign an indemnity agreement.

This is so that the business is protected from liability. When it comes to surety an indemnity agreement is a signed document between a principal and a surety, it states that the principal will indemnify the surety should a claim occur. Indemnification is the process to make whole again.

For example,

If a surety pays out on a claim $20,000 the principal would need to indentify the surety by repaying them $20,000. Generally, all business owners will need to sign an indemnity agreement.

Sometimes only the best applicant will need to sign in other cases the indemnity agreement may require spousal indemnity or third-party witness to all signatures.

Related Forms:

Other Forms

- Affidavit Forms

- Assignment Forms

- Attorney Forms

- Bankruptcy Forms

- Bill of Sales Forms

- Borrow, Lend & Collection Forms

- Business Forms

- Confidentially Forms

- Contract Forms

- Copyright Forms

- Corporation Forms

- Credit Form

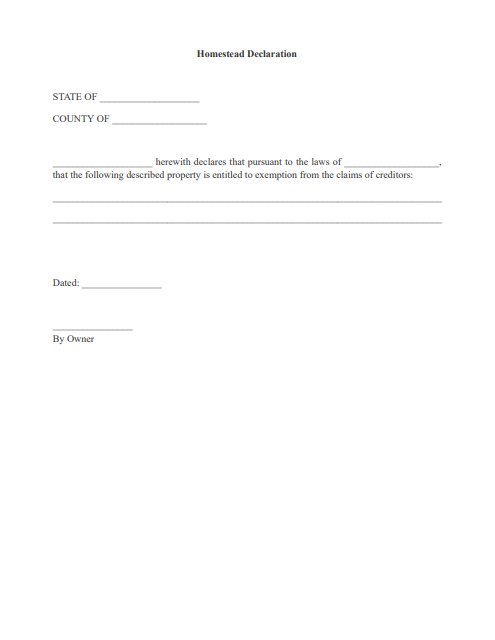

- Declaration Form

- Deed Forms

- Divorce Forms

- Employment Forms

- Entertainment Contract Forms

- Family Law Forms

- Free Will Forms

- Government Form

- Health Care Forms

- Homestead Form

- Indemnity Agreement Form

- Intellectual Property Forms

- Internet Forms

- Landlord and Tenant Forms

- Lease and Rental Forms

- Letter Forms

- Limited Liability Co. Form

- Non-Compete Forms

- Non-Disclosure Forms

- Notice Forms

- Parental Permission Forms

- Partnership Forms

- Power of Attorney Forms

- Premarital Forms

- Promissory Notes

- Real State Forms

- Release Forms

- Sale & Purchase Forms

- Technology Forms

- Trademarks Forms

- UCC Forms