A standstill agreement may be used as a form of defense to a hostile takeover when a target company acquires a promise from an unfriendly bidder to limit the amount of stock that the bidder buys or holds in the target company

By obtaining the promise from the prospective acquirer, the target company gains more time to build up other takeover defenses. In many cases, the target company promises, in exchange, to buy back at a premium the prospective acquirer’s stock holdings in the target.

Common shareholders tend to dislike standstill agreements because they limit their potential returns from a takeover.

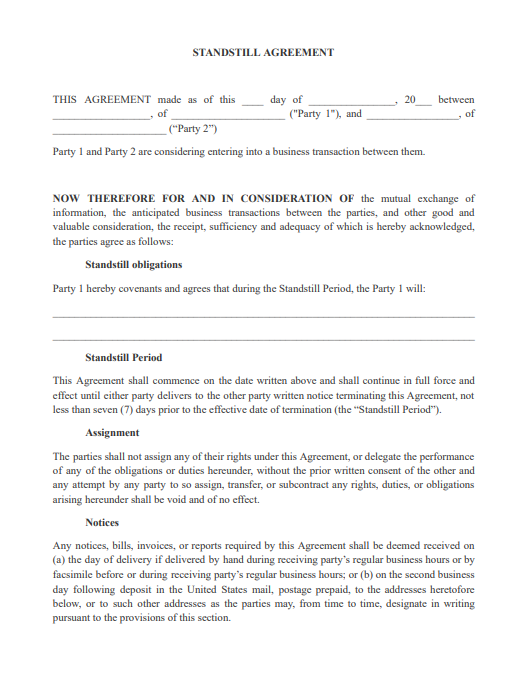

Another type of standstill agreement occurs when two or more parties agree not to deal with other parties in a particular matter for a period of time. For example, in negotiations over a merger or acquisition, the target and prospective purchaser may each agree not to solicit or engage in acquisitions with other parties. The agreement increases the parties’ incentives to invest in negotiations and due diligence, respecting their own potential deal.

Standstill agreements are also used to suspend the usual limitation period for bringing a claim to court.

Related Forms:

Other Forms

- Affidavit Forms

- Assignment Forms

- Attorney Forms

- Bankruptcy Forms

- Bill of Sales Forms

- Borrow, Lend & Collection Forms

- Business Forms

- Confidentially Forms

- Contract Forms

- Copyright Forms

- Corporation Forms

- Credit Form

- Declaration Form

- Deed Forms

- Divorce Forms

- Employment Forms

- Entertainment Contract Forms

- Family Law Forms

- Free Will Forms

- Government Form

- Health Care Forms

- Homestead Form

- Indemnity Agreement Form

- Intellectual Property Forms

- Internet Forms

- Landlord and Tenant Forms

- Lease and Rental Forms

- Letter Forms

- Limited Liability Co. Form

- Non-Compete Forms

- Non-Disclosure Forms

- Notice Forms

- Parental Permission Forms

- Partnership Forms

- Power of Attorney Forms

- Premarital Forms

- Promissory Notes

- Real State Forms

- Release Forms

- Sale & Purchase Forms

- Technology Forms

- Trademarks Forms

- UCC Forms